What numbers should I measure in my business?

We recently looked at the importance of knowing your numbers in business. There are a lot of benefits to knowing your business numbers, but one of the biggest questions you might have is, what numbers should I measure in my business? Let’s take a look at some of the most useful numbers you should measure in your business on a regular basis.

How do I measure the numbers in my business?

As a business owner, a useful way to look at the most important numbers you should be measuring for your business, is to create a business scorecard. A business scorecard considers 4 or 5 important numbers, that are considered the key drivers in your business.

How do you create a business scorecard?

You can create a business scorecard by using a spreadsheet or existing template that a business coach or consultant may already have. The scorecard will include areas for the main numbers to measure, as well as an area to make additional notes or comments.

The most important numbers to track in your business

One set of numbers to review and use in your business is your financials. By keeping track of your financial position on a consistent basis, you may notice or recognise areas that require further investigation and action. We refer to numbers such as financials as “lag” indicators as these give us an indication of what has already occurred in your business, possibly even up to 3-6 months ago.

There are 3 key financial reports that you should review on a regular basis. These are:

Profit & Loss - this report highlights the revenue (sales), expenses andyour overall profit (or loss), at a particular point in time. The profit and loss highlights revenue that you have invoiced, not cash received.

Cash Flow - this report demonstrates the cash coming into your business (income or revenue), verse the cash going out of your business (expenses). This report is a very useful tool for any business, as you want to ensure that your account remains in a surplus. Cash has a significant impact on your ability to operate, maintain relationships with suppliers, pay your staff and invest in growth initiatives for your business.

Balance Sheet - the balance sheet for your business provides a summary of all your assets and liabilities. These are separated into current (i.e. they are easily converted into cash - eg. cash at bank, stock), and non-current (i.e. these assets or liabilities require additional time to convert into cash - eg. property).

Although “lag” measures give you a good understanding of what has occurred in your business, we would suggest that measuring and reviewing “lead” measures or indicators is even more important.

Some “Lead” metrics for you to consider measuring

Leads - A lead is a new opportunity for your business that has the potential to turn into new income for your business. Together with your leads, it is important to keep track of the key activities that drive new customers and revenue to your business - e.g calls and meetings. This will allow you to gain a better understanding of the time and financial commitment required to obtain a lead and how it impacts your overall business.

Conversions - Further to your leads, it is important to track your actual conversions into new clients/products purchased. Areas to consider as part of conversions is the capability of your staff and whether they may require additional training, and whether you have a process for following up in place.

Average Sale Value - Another useful measurement to consider is the average sale value for your business. Is it in line with what you would have expected? What impact would an increase to your pricing make? Could you consider ‘add on’ sales to increase your average sale value?

The power of measuring the numbers in your business

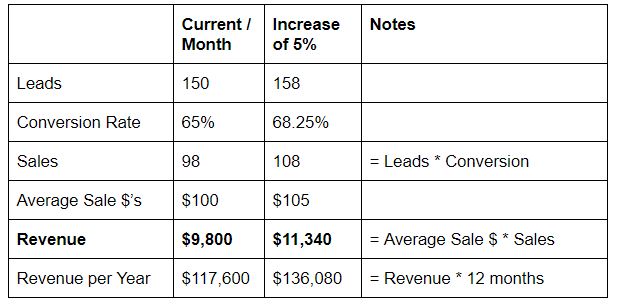

What impact to your revenue and profit (or loss) would occur, if you were to make a 5% change to any (or all) of these numbers in your business?

Example: The Physio

As the above example shows, by making just a small 5% increase to these key numbers, you can make a notable increase to your revenue. Why not try this with your numbers to see what difference it can make?

Reviewing a variety of numbers in your business on a regular basis can have a big impact on your revenue, and ultimately your bottom line. Taking the time to measure your numbers or results each week, fortnight or month, can greatly assist the decisions you make and the actions you take. What gets measured, gets managed. And by thinking about the future of your business over a longer time frame, makes it feel like anything is achievable.

.jpg)

.jpg)

.jpg)